Where to save or splurge in first home is a critical decision for any new homeowner. It’s a balancing act between your financial aspirations and your lifestyle desires. This guide explores the key factors to consider, from initial budget planning to evaluating different financing options, ultimately helping you decide where to prioritize your resources.

This post delves into the world of saving versus splurging on your first home. We’ll look at smart saving strategies, examining options like high-yield savings and automated saving plans. Conversely, we’ll also consider the pros and cons of splurging on a more expensive home, examining location, neighborhood factors, and the value proposition of various features. Ultimately, the goal is to help you make an informed decision that aligns with your personal values and long-term goals.

Initial Considerations for First-Time Homebuyers

Navigating the exciting but potentially daunting world of homeownership for the first time requires careful consideration. Understanding the nuances of saving versus splurging is crucial to making informed decisions that align with your financial situation, lifestyle, and long-term goals. This exploration delves into key factors for first-time homebuyers, emphasizing a practical approach to budgeting, financing, and managing the realities of homeownership.The path to homeownership is often paved with careful planning and realistic expectations.

It’s not simply about finding a house; it’s about understanding the financial and practical implications of owning a home. This involves more than just the purchase price; it includes ongoing costs, potential risks, and the importance of long-term financial planning.

Key Factors in Choosing to Save or Splurge

Careful evaluation of your financial situation and lifestyle is paramount when deciding between saving and splurging on a first home. Several crucial factors must be considered.

- Budget: A detailed budget is essential for assessing affordability. This includes not just the down payment but also ongoing expenses like property taxes, insurance, maintenance, and utilities. A well-defined budget helps you determine the maximum price point you can realistically afford without jeopardizing your financial stability. For example, a family with two children and a higher income may have a greater capacity to splurge than a single person with limited income and expenses.

- Lifestyle: Consider your lifestyle preferences and needs. A young professional might prioritize a smaller, urban apartment, while a growing family might need a larger, more spacious home in a different neighborhood. Your lifestyle will impact the type of home you seek and the amount you are willing to spend.

- Long-Term Goals: Align your home purchase with your long-term financial objectives. Are you planning to stay in the home for a short or long period? Are you anticipating significant life changes or career advancements that might affect your housing needs in the future? Consider the potential return on investment and how it fits into your overall financial strategy.

Establishing a Realistic Budget

Creating a realistic budget is crucial for making informed decisions about saving versus splurging. Understanding your income and expenses is the first step in establishing a financial plan for your first home.

- Income and Expenses: Thoroughly document your monthly income and expenses. Include all sources of income and categorize your expenses into essential (housing, utilities, food) and discretionary (entertainment, dining out). This detailed analysis helps determine your disposable income and the amount you can comfortably allocate toward a down payment and ongoing homeownership costs.

- Potential Savings: Identify areas where you can increase your savings. This could involve cutting back on non-essential expenses, increasing your income through a side hustle, or exploring investment opportunities. A higher savings rate allows you to make a larger down payment, which can influence your borrowing options and potentially lower interest rates.

Understanding Financing Options

Understanding the various financing options available is essential to make informed decisions about your home purchase. Different options come with different implications for saving or splurging.

- Mortgages: Explore various mortgage types, including fixed-rate and adjustable-rate mortgages. Consider factors like interest rates, loan terms, and closing costs. Different mortgage options offer varying degrees of affordability and financial implications, influencing your ability to splurge or save.

- Implications for Saving or Splurging: The chosen financing option directly impacts the amount you can borrow and the monthly payments. A higher down payment can lead to lower interest rates and monthly payments, allowing you to potentially splurge on a more expensive property. Understanding these implications is crucial for making the right choice that aligns with your budget and long-term goals.

Common Pitfalls and How to Avoid Them

Awareness of common pitfalls is crucial for successful first-time homebuyers. Understanding these pitfalls and how to avoid them is essential for a smoother homeownership journey.

- Overextending Your Budget: Avoid the temptation to overextend your budget in pursuit of a larger or more desirable home. A realistic budget is crucial to avoid future financial strain. Researching and comparing properties within your budget range is essential.

- Ignoring Hidden Costs: Be aware of all associated costs beyond the purchase price. Consider factors like property taxes, insurance, HOA fees (if applicable), and potential maintenance or repair costs. This comprehensive view of costs allows for more realistic budgeting and decision-making.

Evaluating Homeownership Costs

Assessing the total cost of homeownership is essential for long-term financial planning. Understanding the ongoing expenses beyond the initial purchase price is crucial.

- Maintenance and Repairs: Plan for regular maintenance and potential repairs. A well-maintained home not only preserves its value but also reduces unexpected expenses. A home inspection before purchase is important to identify potential issues.

- Unexpected Expenses: Be prepared for unforeseen expenses, such as plumbing or electrical issues. Building an emergency fund is a critical step in managing these unexpected expenses, ensuring financial stability during homeownership.

Saving Strategies for First-Time Homebuyers

Buying your first home is an exciting but often challenging journey. One of the biggest hurdles is accumulating enough savings for a down payment and closing costs. A well-structured savings plan, tailored to your specific circumstances, can significantly increase your chances of homeownership success. This section will Artikel various saving strategies, automation techniques, and methods for tracking progress, ultimately guiding you toward your dream home.A comprehensive savings plan isn’t just about the amount you save; it’s about consistently building financial discipline and achieving your long-term goals.

This includes establishing an emergency fund in parallel with your home-buying fund. A strong foundation of financial habits will serve you well beyond the purchase of your first home.

High-Yield Savings Accounts

High-yield savings accounts offer competitive interest rates compared to traditional savings accounts, allowing your money to grow faster. These accounts are generally accessible, with minimal restrictions on withdrawals, and are a good starting point for building your savings. Look for accounts with advertised annual percentage yields (APY) that are significantly higher than typical savings accounts. For example, a high-yield account with a 4% APY will earn more interest over time than a traditional savings account with a 0.01% APY.

Certificates of Deposit (CDs)

CDs offer a fixed interest rate for a specific term, typically ranging from a few months to several years. The interest rate is generally higher than a savings account, but access to your funds is restricted during the term. CDs are a suitable option for those seeking a guaranteed return on a certain amount of money for a specific period, especially if you have a particular timeline in mind for your home purchase.

Investment Accounts

Investment accounts, such as brokerage accounts or retirement accounts, allow you to invest in stocks, bonds, or other assets. While offering potentially higher returns than savings accounts, they also carry higher risk. Investment accounts are ideal for long-term savings, and you should consider your risk tolerance and investment knowledge when choosing this strategy. Diversification across various investment options is often recommended.

For example, a portfolio containing both stocks and bonds can help balance risk and return.

Automating Savings

Setting up automatic transfers from your checking account to your savings account on a regular schedule, such as weekly or bi-weekly, is crucial for consistent savings. This removes the mental hurdle of manually transferring funds, ensuring consistent savings without conscious effort. This method is a powerful tool in building long-term savings habits.

Establishing a Consistent Savings Plan

A consistent savings plan is paramount to your homeownership goals. Create a budget that prioritizes savings, and allocate a specific amount to your home purchase fund each month. Consistency is key; regular contributions, no matter how small, will compound over time. This disciplined approach will make your homeownership goals more attainable.

Tracking Progress and Adjusting Strategies

Regularly tracking your savings progress is essential to monitor your progress toward your goal. Use a spreadsheet, budgeting app, or financial tracking software to monitor your income, expenses, and savings. Adjust your savings plan as needed based on your financial situation. For instance, if unexpected expenses arise, you might need to temporarily reduce your savings contributions, but strive to resume your original savings plan as soon as possible.

Building an Emergency Fund

Building an emergency fund is vital before and after buying a house. A minimum of 3-6 months of living expenses should be saved in a separate account. This fund provides a safety net in case of job loss, medical emergencies, or other unforeseen circumstances. It also demonstrates financial responsibility, which can be a factor in securing a mortgage.

A step-by-step guide to building an emergency fund:

- Determine your current monthly expenses.

- Calculate 3-6 months’ worth of essential expenses.

- Create a dedicated savings account for the emergency fund.

- Set up automatic transfers to the emergency fund.

- Regularly review and adjust your contributions based on your financial situation.

Sample Monthly Budget Prioritizing Savings, Where to save or splurge in first home

A well-structured budget is crucial for saving effectively. Here’s a sample budget that prioritizes savings for a down payment:

| Category | Amount |

|---|---|

| Rent/Mortgage | $1,500 |

| Utilities | $200 |

| Food | $300 |

| Transportation | $200 |

| Entertainment | $100 |

| Savings (Home Down Payment) | $500 |

| Other Expenses | $200 |

| Total | $3,000 |

This budget demonstrates how allocating a specific amount for savings can be incorporated into your monthly spending plan. Adjust amounts according to your individual needs and financial situation.

Splurging on a First Home: Where To Save Or Splurge In First Home

Deciding whether to splurge on a more expensive first home can be daunting. It often involves weighing immediate financial pressures against long-term goals. While affordability is crucial, considering the potential benefits of a more expensive property can lead to a more fulfilling and valuable homeownership experience. This exploration delves into the advantages and disadvantages of a pricier purchase, helping you make an informed decision.Evaluating a more expensive first home requires a nuanced approach, looking beyond the sticker price to the overall value proposition.

It’s about assessing whether the extra cost aligns with your lifestyle, future needs, and potential for financial growth.

Deciding where to save or splurge in your first home can be tricky. A great place to save might be on basic furnishings, but consider investing in a statement piece like a beautiful, low-maintenance plant. For example, a stunning Dumb Cane Dieffenbachia, known for its striking foliage and easy care, is a fantastic addition that can instantly elevate a space without breaking the bank.

Finding the perfect dumb cane dieffenbachia definition and its care tips can help you make the right choice. Ultimately, the key is to balance practicality with personality when making those crucial design decisions.

Comparing Expensive and Affordable Homes

Purchasing a more expensive home can provide more space, higher quality features, and a more desirable neighborhood. However, it often comes with a higher mortgage payment and increased maintenance costs. An affordable home, while potentially requiring more upkeep, offers greater financial flexibility in the short term.

Larger vs. Smaller Homes

Choosing a larger home might seem appealing, but it can lead to higher utility bills and maintenance costs. A smaller home, while potentially needing more effort in upkeep, offers more financial freedom. The decision hinges on your lifestyle and future needs. For example, a growing family might benefit from a larger space, whereas a single individual might find a smaller home more manageable.

A crucial factor is the ability to adjust to the needs and priorities that change over time.

New vs. Older Homes

New homes often come with modern features and warranties, while older homes may require renovations. The costs associated with renovations and repairs for older homes can outweigh the potential savings in the long run. The advantages and disadvantages depend on your tolerance for repairs and your financial resources. For example, a new home may be more expensive upfront but might have lower long-term maintenance costs due to energy efficiency features.

Older homes might have unique character and charm.

Trade-offs in Features and Price

When considering a more expensive home, you’ll encounter trade-offs between features and price. A higher-priced home might include premium appliances, upgraded finishes, or a larger lot size. These features could lead to greater enjoyment but often come with a significant price premium. Examples include granite countertops, hardwood floors, or a more expansive backyard.

Evaluating Value Proposition

Evaluating the value proposition of a more expensive home requires considering various factors beyond just the purchase price. Neighborhood amenities, such as proximity to schools, parks, and public transportation, play a significant role. The potential for future appreciation in the area also needs careful consideration. For instance, a home in a developing neighborhood with projected growth could yield a higher return on investment in the long run.

Location and Neighborhood Analysis

Finding the right location is crucial for a first-time homebuyer. It’s not just about the house itself; it’s about the entire lifestyle the neighborhood offers. A well-chosen location can significantly impact your daily life, future financial gains, and overall happiness. Understanding the neighborhood’s character, amenities, and potential for growth is paramount. This analysis goes beyond just the asking price; it’s about assessing the long-term value and fit for your needs.Neighborhoods vary drastically in their characteristics.

A bustling city center might offer great access to work and entertainment but come with higher costs and potential noise. A quieter suburban area might offer a more peaceful lifestyle but could have longer commutes. Careful consideration of these factors is essential for making an informed decision.

Neighborhood Comparison

A crucial step in evaluating potential neighborhoods is a comparative analysis. This table highlights key factors for different areas. Note that these are examples and actual data will vary significantly depending on the specific location.

| Neighborhood | Schools | Commute Time (Avg.) | Safety Rating | Amenities |

|---|---|---|---|---|

| Downtown Heights | Excellent public schools, highly rated private options | Short, often walking distance to work | High, low crime rates | Extensive dining, nightlife, and cultural options |

| Oakwood Estates | Good public schools, limited private options | Moderate, typically a 15-20 minute drive to major employment centers | Very Good, lower crime rates than Downtown | Parks, community centers, and local shops |

| Riverside | Average public schools, few private schools available | Long, typically a 30-45 minute drive to major employment centers | Fair, slightly higher crime rates than other options | Quiet residential atmosphere, easy access to nature |

School District Analysis

Schools are a significant consideration, especially for families with children. Understanding the school district’s reputation, test scores, and extracurricular activities is essential. Researching school rankings, teacher evaluations, and student performance data is critical.

Commute Time and Transportation

The time and cost of commuting to work and other essential destinations are significant factors. Consider the availability and efficiency of public transportation, the cost of parking, and the traffic conditions. Evaluate how much time and money you’re willing to dedicate to commuting.

Safety and Crime Rates

Neighborhood safety is a paramount concern. Research crime rates, police response times, and community involvement in crime prevention initiatives. Neighborhood watch programs and community policing efforts are valuable indicators of a safe environment.

Amenities and Lifestyle

Assess the availability of local amenities such as parks, shopping centers, restaurants, and recreational facilities. Consider how these amenities fit your lifestyle and preferences. Do you need easy access to a grocery store, or are you happy with a longer drive to a more specialized shop?

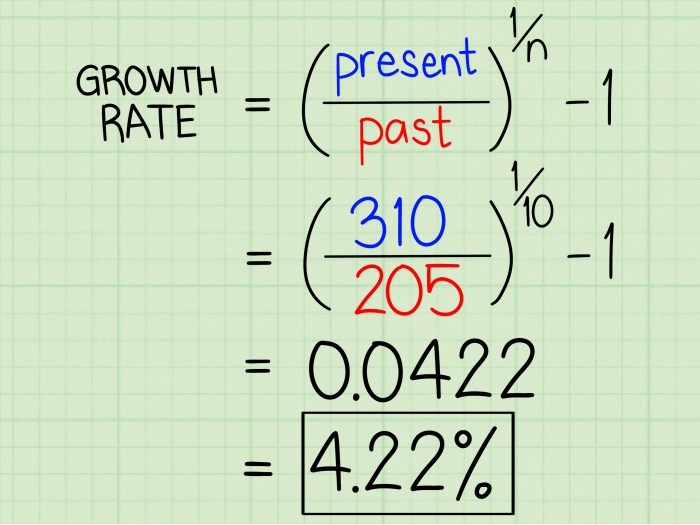

Long-Term Property Value Assessment

Evaluating the long-term value of a property in a particular neighborhood involves analyzing market trends, local economic conditions, and projected growth. Consider factors like employment opportunities, infrastructure development, and the overall health of the local economy. Look for neighborhoods that show potential for appreciation over time. For example, a neighborhood experiencing increased demand from young families or professionals often shows increased property value.

Consider consulting real estate professionals, analyzing historical sales data, and studying market reports.

Impact on Resale Value

Location significantly influences the potential resale value of a property. Properties in desirable neighborhoods with strong amenities and good schools typically command higher prices in resale markets. Analyze how factors like proximity to employment centers, public transportation, and recreational facilities can influence the property’s appeal to future buyers. Historical data and comparable sales in the area are useful resources for estimating future resale value.

Financing Options and Implications

Navigating the world of mortgages can feel overwhelming for first-time homebuyers. Understanding the various financing options available and their implications on your budget and long-term financial health is crucial. This section dives deep into the different types of mortgages, their pros and cons, and strategies for securing the best possible rate.Choosing the right mortgage significantly impacts your monthly expenses and the overall cost of homeownership.

So, you’re finally buying your first home? Deciding where to save and where to splurge is key. For example, while you might want to save on the paint, upgrading your kitchen backsplash with high-quality tiles is a great way to add value and style. Learning how to tile a backsplash yourself can save a significant amount of money, and sites like how to tile a backsplash offer helpful guides.

Ultimately, the best approach balances practicality and personal style, and your first home should reflect your taste and future needs.

A well-informed decision can save you thousands of dollars over the life of the loan, while a poor choice could lead to financial strain.

Mortgage Option Comparison

Different mortgage options cater to various financial situations and risk tolerances. Understanding their key characteristics is essential for making an informed choice.

So, you’re tackling your first home? Deciding where to save and where to splurge is key. For example, while a gorgeous porch swing might seem like a must-have, consider what you really need for daily living. Think about practical items like storage solutions and appliances first. Before you invest in a fancy outdoor furniture set, check out what not to put on your porch here.

Focus on the essentials, and you’ll be set for a great start to your new home!

- Fixed-Rate Mortgages: These mortgages offer a consistent interest rate throughout the loan term. This predictability allows for easier budgeting, as monthly payments remain stable. However, fixed-rate mortgages may not offer the lowest initial rate compared to adjustable-rate mortgages, especially in periods of low interest rates. An example of this would be a 30-year fixed-rate mortgage, where the interest rate remains constant for the entire loan duration.

- Adjustable-Rate Mortgages (ARMs): ARMs feature interest rates that adjust periodically, often based on an index like the prime rate. Initially, ARM rates might be lower than fixed-rate mortgages, offering a potentially lower monthly payment in the short term. However, the rates can fluctuate, leading to higher payments later, especially during periods of rising interest rates. It’s crucial to carefully analyze the ARM’s terms and potential for rate increases before committing.

- Federal Housing Administration (FHA) Loans: These loans are backed by the FHA, allowing borrowers with lower credit scores or smaller down payments to qualify. FHA loans typically have slightly higher interest rates compared to conventional loans, but they make homeownership more accessible to a wider range of buyers. This is beneficial for first-time homebuyers who may not have substantial savings.

- Veteran Affairs (VA) Loans: VA loans are specifically designed for eligible veterans, service members, and surviving spouses. These loans often come with favorable terms, such as no down payment requirements, potentially lower interest rates, and streamlined application processes. This is a significant advantage for those meeting the specific eligibility criteria.

Implications of Mortgage Options

The choice of mortgage profoundly impacts your monthly payments and long-term financial obligations.

- Monthly Payments: Fixed-rate mortgages offer consistent monthly payments, while ARM payments can fluctuate. FHA and VA loans might have slightly higher monthly payments than conventional loans due to the associated insurance premiums or government backing.

- Long-Term Financial Obligations: Fixed-rate mortgages offer predictable long-term costs, whereas ARMs introduce an element of risk with potential for future rate increases. Choosing a loan type should be aligned with your financial goals and risk tolerance.

Strategies for Favorable Mortgage Rates

Securing a favorable mortgage rate is a key aspect of managing your homeownership costs.

- Improve Your Credit Score: A higher credit score generally translates to a lower interest rate. Taking steps to improve your credit score, such as paying bills on time and managing your debt, can be a beneficial strategy.

- Shop Around: Don’t settle for the first mortgage offer you receive. Comparing rates and terms from multiple lenders can yield significant savings.

- Consider a Large Down Payment: A larger down payment often allows you to negotiate a better interest rate.

Loan Type Comparison

This table summarizes the costs and benefits of different loan types.

| Loan Type | Pros | Cons |

|---|---|---|

| Fixed-Rate Mortgage | Stable monthly payments, predictable long-term costs | Potentially higher initial interest rates |

| Adjustable-Rate Mortgage (ARM) | Potentially lower initial interest rates | Variable monthly payments, risk of higher future rates |

| FHA Loan | Accessible to borrowers with lower credit scores or smaller down payments | Higher interest rates than conventional loans |

| VA Loan | No down payment required, often favorable terms, streamlined application process | Limited to eligible veterans and service members |

Understanding Loan Pre-Approvals

Loan pre-approvals are crucial for establishing a realistic budget and negotiating effectively with sellers.

- Impact on Purchasing Decisions: A pre-approval letter demonstrates your financial capability to a seller, strengthening your position in a competitive market. It provides a clear picture of your borrowing power, enabling you to make informed decisions about your budget.

- Evaluation of Loan Pre-Approvals: Carefully review the terms and conditions of the pre-approval letter, paying attention to the loan amount, interest rate, and closing costs. Understanding the details is essential for accurate financial planning.

Making the Right Decision

Choosing between saving and splurging on your first home is a pivotal decision. It’s not simply about the price tag; it’s about aligning your financial goals, personal preferences, and long-term vision. This crucial juncture requires careful consideration, weighing the immediate gratification of homeownership against the potential for future financial security.The decision isn’t solely based on the purchase price, but rather a complex interplay of financial prudence and personal aspirations.

A meticulously crafted approach will help you navigate the decision-making process and achieve a favorable outcome.

Factors to Consider

Several key factors influence the choice between saving and splurging on a first home. Financial preparedness is paramount, including a robust emergency fund, sufficient savings for a down payment, and the ability to comfortably manage monthly mortgage payments and associated expenses. Personal preferences also play a role, such as the desired location, home size, and features. Understanding your lifestyle and future plans is crucial in making an informed decision.

Financial Considerations

Evaluating your financial position is essential. A detailed budget analysis reveals your current income, expenses, and potential savings. Calculate the required down payment, considering loan terms and interest rates. Project future expenses, including property taxes, insurance, and maintenance. Understanding the long-term financial implications of both options is vital.

Personal Preferences

Personal preferences should not be overlooked. Consider your lifestyle, including family size, desired neighborhood, and desired home features. Evaluate the trade-offs between a smaller, more affordable home now versus a larger, more luxurious home later. Prioritize your needs and desires to ensure the home aligns with your long-term vision.

Compromise Strategies

Compromises are often necessary when balancing saving and splurging. Consider a slightly smaller home or a less desirable location in exchange for a lower mortgage payment. Negotiate with sellers to reduce the asking price or explore financing options that reduce the initial investment. Explore options for shared ownership or cooperative housing to potentially reduce upfront costs.

Examples of Successful Strategies

Many first-time homebuyers successfully navigated this decision by focusing on specific financial goals. Some individuals strategically saved for a larger down payment over time, allowing them to purchase a more desirable home later. Others opted for a smaller home in a less expensive location, prioritizing affordability and stability. These examples highlight the importance of tailoring the decision to individual circumstances and aspirations.

Decision-Making Framework

To effectively balance financial considerations and personal preferences, a structured decision-making framework is beneficial. First, assess your current financial situation, including savings, debts, and income. Next, evaluate your personal preferences, including desired location, home size, and features. Then, compare the potential costs and benefits of saving versus splurging. Finally, consider potential compromises and evaluate the long-term financial implications of each option.

End of Discussion

Navigating the world of first-time homeownership can feel overwhelming. However, by carefully considering your budget, lifestyle, and long-term goals, you can make an informed decision about where to prioritize saving versus splurging. This guide provides a framework for understanding the financial implications and practical steps to take, empowering you to confidently embark on this exciting journey. Remember, your first home is a significant investment; make the right decision for you and your future!